Rising house prices in London have affected most residents of the Royal Borough of Kingston upon Thames, a recent survey has found.

Nearly 80% of respondents said that they spend most of their household’s income on rent or mortgage, and one in six said they cannot afford to live in the borough anymore.

The online survey conducted by Kingston Courier in March 2024 involved 653 respondents from local Facebook groups, representing different neighbourhoods.

While most of them admitted struggling, a small group of people said the prices were well-balanced or even cheap.

One local resident Jenny Sinnott said: “It’s affordable for rich people, so many property millionaires! South London has really benefitted from house price rises.”

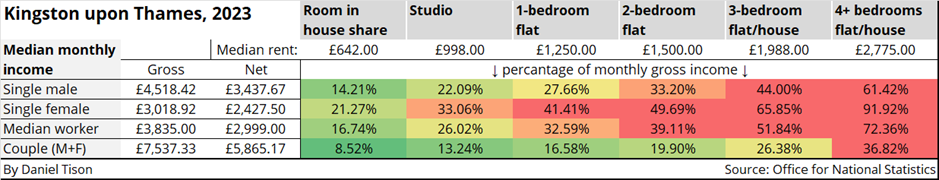

According to the Office for National Statistics (ONS), a household should spend 30% or less of its gross income on rent or mortgage.

However, this applies only to 5% of the Kingston residents who took part in our survey.

The London Rents Map shows average monthly private sector rents across London, based on a sample covering the last 12 months.

In the list of London boroughs, Kingston is roughly in the middle in terms of rent.

Accommodation prices range from £642 per room to £2,775 for a 4-bedroom house.

The borough median is currently £1988, which is 88% of the London Living Wage (working full-time for £13.15 per hour).

However, most people in Kingston earn more than that, according to ONS’s data from 2023.

A median salary full-time worker in Kingston earns about £3,835 a month, which barely allows them to afford a median one-bedroom flat for £1,250 (nearly 33% of gross income).

A median waged heterosexual couple with a monthly gross income of £7,537 can share a median three-bedroom flat or house for £1,998 a month (26% of gross income), but can hardly afford a house with four or more bedrooms.

The situation may be more challenging for single women, because female workers make a third less than males, based on median annual salary in Kingston.

Aimée Arnold moved from Surbiton to Portsmouth in 2021, because she could not afford living in London anymore.

“A three-bed house is half the price as it would have been [in Surbiton],” she said.

Since 2021, millions of Britons have been facing the cost-of-living crisis where bills have been increasing more quickly than average household income.

With high property prices and rising rents, the UK is also facing a crisis in housing affordability, according to housing charity Crisis UK.

Rents in England’s capital has risen across all boroughs except Ealing compared to last year, according to data published by Statista in January 2024.

Barbara Rowing, a Kingston resident, believes that the issue results from the expanse of private rent sector at the expense of social housing.

She said: “The day they made individual private landlords was the day it all started to go wrong. Should never have been allowed. More social housing landlords are required.”

The social housing sector has shrunk over the long term, from 5.5 million homes provided by local authorities in 1979 to 4.1 million in 2022, according to Government data.

The number has further decreased to around 3.8 million in March 2023, researchers from House of Commons Library have estimated.

Kingston Council has acknowledged the issue and has committed to the development of high-quality, affordable homes for local people.

A spokesperson for the council said: “We are currently undertaking a major regeneration in the borough to provide 2,170 new homes, with 871 new council homes on the Cambridge Road Estate.”

Nevertheless, some people believe that living in Kingston is worth the price.

Melanie Watson, a Kingston resident, said: “Obviously you pay a premium to live in a London borough where you have a 14-minute train service to Waterloo. Prices are based on supply and demand.”

This article was updated on April 14 to clarify that the ONS data quoted is for gross income not net income.

Junior journalist and PR freelancer, with more than three years of experience in the media industry. Combining my creative spirit and analytical thinking, I aspire to spread accurate, unbiased, and valuable information, in a simple and attractive way.