The expense of living in England remains a hot topic of conversation across the country. Understandably, mortgage and rent costs are two of the greatest sources of worry.

Sadly, the latest data from Rightmove points to a continuing trend of potential buyers and renters being priced out of Kingston and its surrounds, with an ongoing affordability crisis showing no signs of ceasing.

Despite the Housing Price Index for March 2023 indicating that the average house price in London has dropped by 0.1%, figures remain staggeringly high in the capital compared with the rest of the nation.

Which factors make mortgages and rents so expensive?

Mortgage prices typically fluctuate with the rate of inflation, but an increased demand for a reduced supply – or more people applying for fewer housing options – has had a significant impact on the cost of renting in the London suburbs, too.

Marc von Grundherr, Director of Benham and Reeves estate agents in London, explained that this is “down to the reversal of the pandemic inspired exodus” of Londoners to less expensive areas. “This reversal has been driven by a return to normality, both socially and within the workplace, with many now keen to return to the convenience that London living provides,” he said.

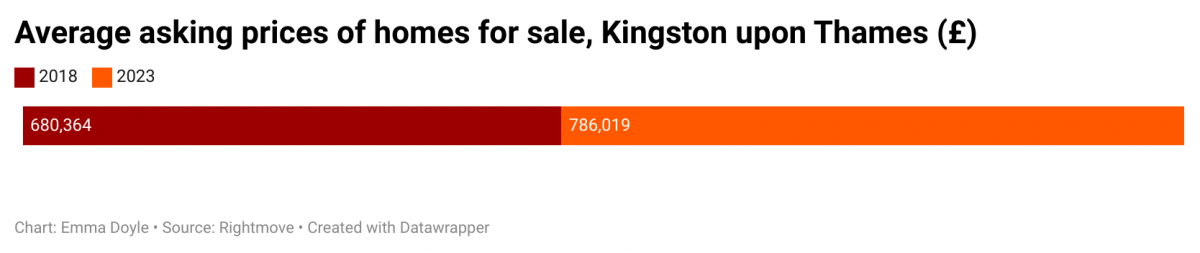

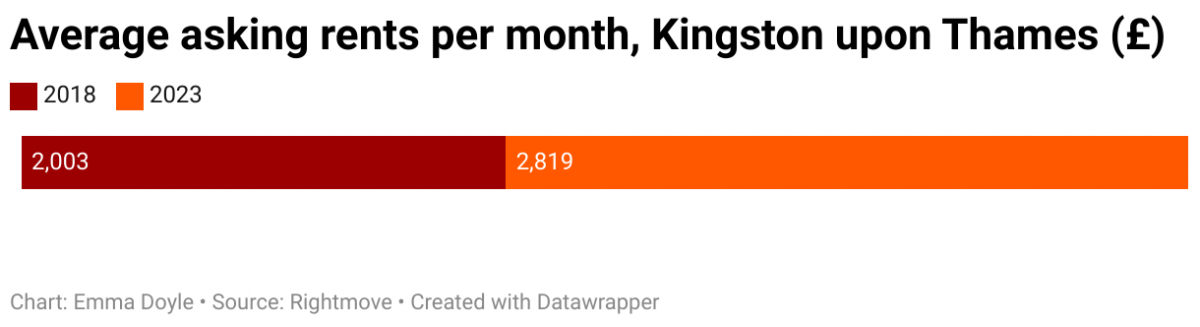

Illustrating this desire to relocate closer to the capital are Rightmove’s figures for Kingston-upon-Thames from 2018 to 2023. Although asking prices for buyers have seen a somewhat modest increase of 16 percent in the last five years, average asking prices for prospective renters tell a different story. This figure has leapt from £2003 per calendar month to £2819, amounting to an eye-watering hike of 41%.

The Office for National Statistics published analysis leading up to the end of March which placed the average weekly earnings in Britain at £589 in regular pay, or roughly £2650 per month. In addition, the ONS found that one in three UK adults making rent or mortgage payments found it difficult to make ends meet, and that once inflation has been taken into account this average wage has fallen.

As per the 2021 census data provided by Kingston Council, 42.5% of properties in the town centre were privately rented. Across the borough, 27.3% of homes were privately rented, with a potentially surprising statistic of 32.6% of homes being owned with a mortgage or a loan.

“I’ve moved an absolutely crazy number of times, and it’s been traumatic.”

Nick, former Kingston resident

Nick, who last lived in Kingston between October 2021 and May 2022, told the Courier that his last search for a viable rental in the area at the beginning of this year lasted two months, and ultimately left him homeless. “If I didn’t have friends who just so happened to be able to put me up for varying lengths, I would have been on the streets,” he said.

“I’ve moved an absolutely crazy number of times – my current rent is my seventh since 2018 – and it’s been traumatic.”

Nick described an attempt to find housing on app SpareRoom, during which he saw an advertisement for an ‘en-suite’ bedroom that turned out to be a bathroom with a change of tiling at one end, and a bed placed at the other. This prompted him to relocate to Bristol to “try [his] luck” in a different city, but only served to highlight how the competition amongst potential tenants was “even more fierce there”. He says this, along with a “disastrous” economic policy introduced by the longstanding Conservative government, has led him to see living standards drop as people become more desperate.

When will this trend change?

Unfortunately, no one really knows. With the economic landscape in a constant state of flux and ever-increasing holding deposits, it’s almost impossible to predict how the housing market may look in another five years’ time.

Writing for the Telegraph, Melissa Lawford hints at experts’ fears of a further crash. However, most major mortgage lenders such as Nationwide and Halifax publish monthly Housing Price Index updates, as well as regular news articles concerning the latest sector movements.

Using these to stay ahead of any wind changes – and a good deal of personal resolve – can hopefully help those searching for housing feel a little more confident.