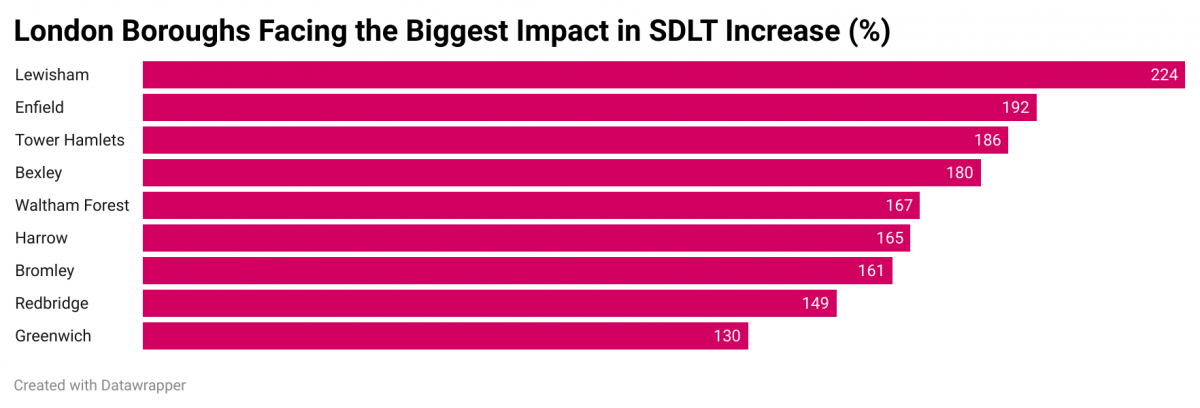

From 1 April 2025, stamp duty will increase significantly for first-time buyers in South East London, rising by more than £11,000 in some boroughs.

The biggest jumps will hit areas like Greenwich, Lewisham, Bexley and Bromley, where homebuyers will see their upfront costs nearly triple.

A report from Compare My Move highlights the stark differences in how the changes will impact London boroughs.

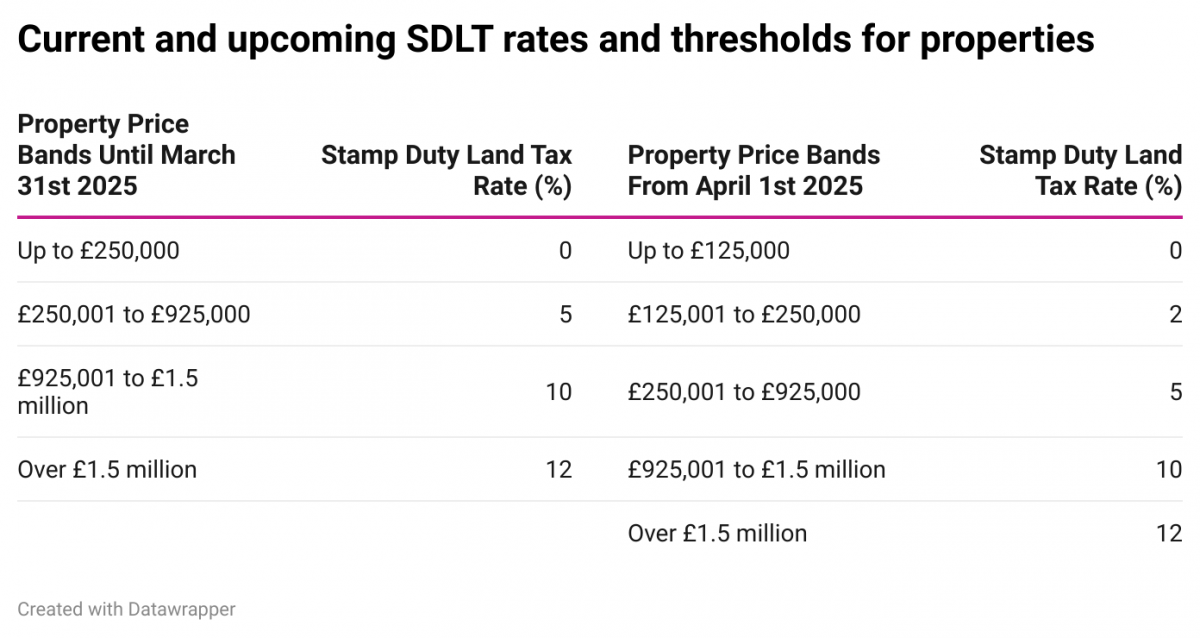

First-time buyers pay no stamp duty on properties up to £425,000, with a 5% rate applied to homes up to £625,000.

From April, the tax-free threshold will drop to £300,000, and the 5% rate will apply to properties between £300,001 and £500,000. Homes above £500,000 will follow standard stamp duty rates.

The most affected boroughs include Greenwich, where the average home costs £598,726. Here, first-time buyers will see stamp duty rise from £8,686 to £19,936, an increase of £11,250. In Lewisham, the tax will jump from £5,014 to £16,264. Buyers in Bexley and Bromley, traditionally more affordable areas, will also see steep rises of over £11,000.

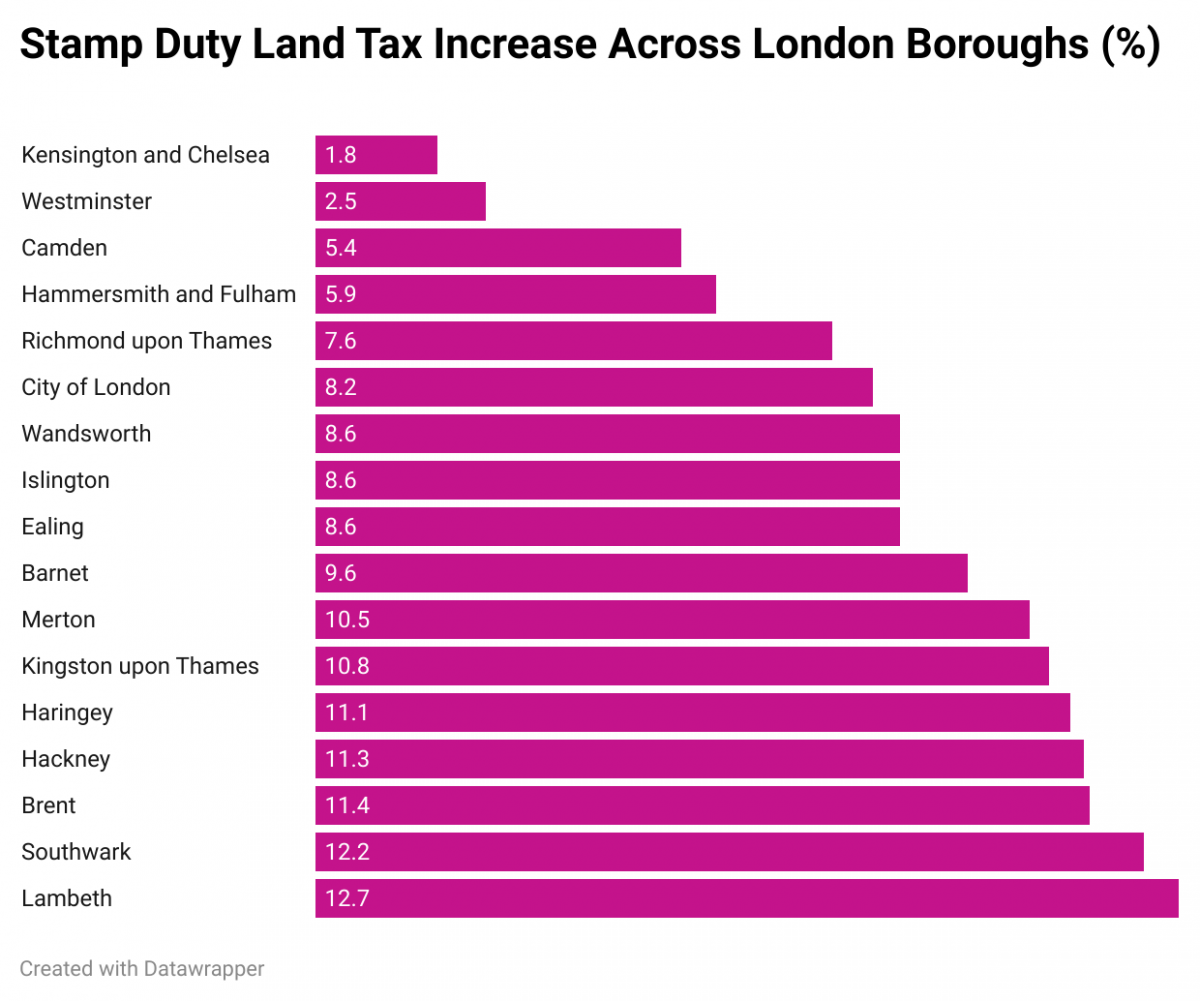

In contrast, wealthier boroughs, such as Kensington and Chelsea and Westminster, will see relatively minor increases.

In Kensington and Chelsea, where the average home costs nearly £2m, stamp duty will only rise by £2,500, a 1.8% increase. Westminster buyers will see a similar rise of around £2,500. Meanwhile, Kingston upon Thames will experience a 10.8% increase, with stamp duty rising from £23,111 to £25,611 on an average property price of £712,231.

The changes reverse temporary cuts introduced in 2022, which were designed to boost the housing market.

Then-Chancellor Kwasi Kwarteng said the increase in stamp duty relief thresholds would help more people buy their first homes. However, the relief measures were only temporary and will now be rolled back, bringing costs back up from April 2025.

Experts warn that the sudden increase in stamp duty could drive many first-time buyers out of the market entirely. Halifax data shows that the number of first-time buyers in the UK fell by 8% between 2014 and 2024, a trend that could worsen under the new tax rules.

Dave Sayce, CEO of Compare My Move, warned that these increases will make it even harder for first-time buyers in London.

“We are seeing a decrease in the number of affordable areas to buy property in London,” he said, “and with this, we will see a decrease in the number of first-time buyers.”

He added: “Buyers with lower incomes will be impacted harder by the end of stamp duty relief. They will either have to take longer to save for the upfront costs that come with buying the average house or lower their budget to below the threshold.”

The shift could have effects beyond the housing market with Sayce predicting an increased demand for rental properties, pushing rents even higher.

Mortgage lenders may offer some relief through low or no-deposit mortgage schemes, but for many, the higher upfront cost will be a major barrier to getting on the property ladder.